Mayor's Recommended 2023 - 2024 Budget

Mayor Steve Hogan has presented his budget for 2023-2024 to the Camas City Council, please visit https://finance.cityofcamas.us/#!/dashboard to view the presentation and budget materials.

In addition, we have provided additional budget information in the PDF below which shows how City of Camas taxes compare to other cities in Clark County. Please note, Camas offers more services than most cities on the list.

Have you ever wondered where your property taxes go in Camas? As we budget for the 2023-2024 biennium, we wanted to break down your property taxes. In this first pie chart, you’ll see how your tax bill breaks down. In the second, you’ll see the percentage of property taxes each City Service gets.

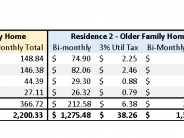

As the City of Camas considers a 3% Utility Tax increase to help provide the same level of service as our population grows, we also wanted to show you how that would impact your utility bill. You can view three different examples of utility bills; find the example that’s closest to your bill to determine the increase you would pay. Column 3 features the increased total on a bimonthly bill.

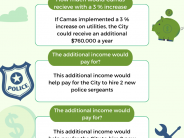

In addition, If the City of Camas implements a 3% utility tax on City’s utilities (water, sewer, stormwater and garbage), the City would receive approximately $760,000 a year. This amount would help the City to hire two new police sergeants, two street maintenance workers, and additional fire staffing and equipment for an average tax bill increase of $6 a month. We have included a graphic that allows you to see what an average tax bill increase of $6 a month would provide for Camas.

Here are some answers to a few questions we've been getting about this process:

Why don't the residents get to vote on this?

- This is council-matic decision by state law, meaning your Council representative will make the “vote” on your behalf.

Will there be an exception for seniors, low income etc.?

- This is an option that Council is currently considering

Would the 3% increase only be used for an increase in staff members?

- It can be used for general services provided to the residents or it can be specific as defined by City Council.

To view the recent presentation on the proposed 3% Utility Tax increase, click on the PowerPoint file below.

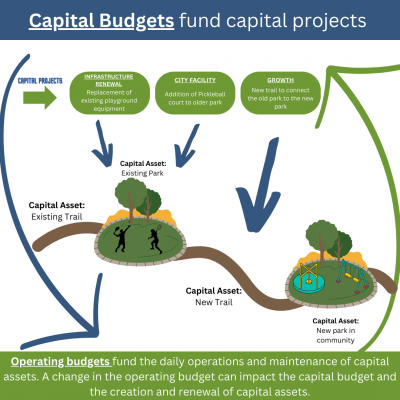

What is a Capital Budget?

Did you know Camas has different kinds of budgets? There is Capital and Operating. Take a look at the park graphic below to understand how the City budgets for different types of expenses, and the impacts they have on one another.

The capital budget is the City’s plan to purchase, build, maintain, repair and replace assets, including infrastructure. Capital assets also, directly and indirectly, impact the City’s operating budget as funds are needed to cover day-to-day operating expenses associated with the asset. You can visit https://finance.cityofcamas.us/#!/dashboard to see the full list of Capital budget decision packages.

An asset is a financial term applied the physical items that the City owns or controls that also have financial value. For example, vehicles are assets as the City can sell the vehicle/equipment/land for cash.

Infrastructure is the term that refers to the equipment and structures the City owns which help make Camas a safe, convenient, and livable community. The City’s infrastructure includes roads, bridges, sidewalks, parks, stormwater facilities, and water and wastewater systems.

Finally, Take a look at this excellent summary of the 2023-2024 Camas Budget done by the Post-Record https://www.camaspostrecord.com/news/2022/oct/06/camas-mayor-unveils-bie...